I’m an investor

Disclaimer: I understand that as a middle class Pākehā woman there are systems of discrimination and inequity that I have benefited from. I want to acknowledge that but also not feel like I have to keep apologising throughout this article for having the luxury of financial stability. Feeling like they don’t deserve to have money is one reason women don’t create long term wealth for themselves and I’d like to contribute to changing that narrative.

Writing my book, and working through it like any other reader would, has been incredibly insightful and illuminating. I can feel myself growing and changing as I start to really understand who I am, who I want to be, and how to get there.

Part of that change is grappling with the idea that for much of my life I have hidden who I am, more worried about how other people rate me than if I’m actually leading my best life. It’s embarrassing to admit that there are very few situations in real life where I would call myself, for example, an investor. That kind of imposter syndrome is so common in women, but even knowing it, naming it, I’m still not sure I could do it!

But here in this space, at least, I can own it: I am an investor! I have a budget and I make sure that at least some of my pay check goes towards some short-term savings and some long-term savings. This is quite exciting for me because I did not learn this stuff as a young person. My parents did not pass on any financial guidance, and didn’t give us a regular pocket money budget to learn from. This is now extremely important to me as a parent.

I love the content on Friends that Invest (formerly Girls that Invest) but I have to be honest: I haven’t actually read the book. I’ve read other books, and a lot of online content, including a lot of Mary Holm who I rate very highly.

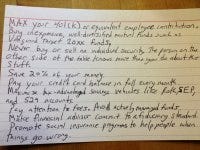

Even some of these authors would agree that investing is not complex enough to fill a whole book. Harold Pollack became known as “the index card guy” after saying in an interview that “the best financial advice for most people fits on a single index card.” Hilariously, he still decided to cash in and co-author a book called The Index Card: Why Personal Finance Doesn’t Have to Be Complicated. Ironic much?

Outside of KiwiSaver, Aotearoa’s retirement saving scheme, my investing journey began in my 20s, and started out as an example of what not to do! My ex-husband and I decided it would be cool to be part of the IPO for a burger chain we loved and the outlay was only $1000. We didn’t own a house, we didn’t have a rainy day fund, and picked one extremely high risk stock. We sold the shares when we separated, and didn’t end up losing any money but that was only dumb luck. That investment goes against all of my investing guidelines these days.

Pay down debt as fast as you can, including your mortgage. No investment will consistently return enough to better the equivalent of your mortgage rate + tax.

Build up a decent rainy day fund that is easily accessible before you start investing.

Max out any investment that gets you a contribution from the government and/or your employer.

Never try and pick individual stocks, always go for an index fund or ETF.

Never try and pick when stocks are up or down, just drip feed your money into your investment and the highs and lows will all balance out over time (the technical term for this is “stock price averaging”).

Now, I’ll be the first to admit that I don’t always follow my own guidelines. Sometimes, other values that are important to me supersede my desire to maximise my financials.

Supporting local

I returned to investing at age 37 when I realised my KiwiSaver fund didn’t include any NZ stocks. At this point I still didn’t *get it* and selected some individual stocks based on (ok this is embarrassing) how cheap they were and whether I’d heard of them. Good grief! But it was important to me that my investment supported the NZ economy rather than solely owning Australian and American stocks because they had the best returns. I’ve since sold most of my single company shares but I’ve hung on to a couple as I don’t want to realise the loss.

Independence

I really like being able to take charge of my finances and have something all of my own. It’s important to me that I don’t rely on someone else to know this stuff for me. It’s great to pay down a mortgage but it’s very passive, and I share it with my husband.

Growth and learning

I didn’t want to wait until our mortgage was paid off to start learning about shares. When I was on maternity leave again at age 39 I sold some shares and made $800. It felt awesome, especially to be able to do that at a time when I didn’t have a regular income of my own.

Fairness and social responsibility

Financial settings in Aotearoa are such that buying a second (or third, or tenth) house is the most common route to growing wealth. But I don’t want to buy a rental property when so many people can’t afford a first home. I don’t want to benefit from a system that disadvantages others, or contribute to that struggle. Financially, this is probably a really dumb choice.

Flexibility and choice

We have chosen to stay in the house we bought 12 years ago. We could have upgraded to a better house or a better school zone, like a lot of people do, but we chose to demolish our mortgage instead. We kept our debt low enough that we had the choice for me to take a full year of maternity leave, because that was important to us. This is also part of the reason we haven’t bought a second property - we’re just not comfortable with that level of debt and how that would lock us into a particular trajectory.

My current approach

We still have a mortgage but it’s not massive. I feel comfortable having a small amount of my money doing other things. We do have a rainy day fund now, but we didn’t when I first opened my Sharesies account.

As well as my 4% KiwiSaver contribution, I have a portfolio with Sharesies that I invest in regularly. Sometimes I’ll pause my auto payment for a few months when things feel tight, or we have a holiday coming up. The amount changes all the time. But Sharesies has this great feature where you can allocate your investment by percentage, so that you can easily spread your investment no matter how small your contribution. Electronically Traded Funds such as Smart Invest make it incredibly easy to spread your risk, and I invest in eight different ETFs. This means my investment is spread across dozens of different companies. I also indirectly own some property, which makes me feel better about our choice not to buy a rental property.

We probably will invest in residential property at some point, but it will be driven by wanting to ensure our four children have secure housing as adults, rather than growing our wealth. And trying to influence (Bribe? Manipulate? 🤣) them to live close to us.

Or maybe we’ll sell up and move to Australia. Who even knows how their life is going to go? But whatever we choose to do, I want to make sure I manage my finances in a way that aligns with my values and supports me to live whatever life I choose.